Ready To Bring Your Business Online?

We specialize in helping business owners create content management systems, online stores, and social networks, enabling them to take ownership of their data and define their own rules.

Maximize Your Online Revenue with Our Expert Assistance

Safeguard your business by empowering it to launch customized online applications, giving you complete control over your data and policies.

Content Management

Efficiently manage your online assets and optimize your content strategy so you maximize the impact of your digital media efforts.

Online Payments

Transform your digital sales strategy with our comprehensive solutions. Monitor and track every step of your sales journey with ease.

Social Networks

Empower your community with streamlined communication channels, enhanced networking features, and interactive tools to drive engagement.

Stay Engaged As We Build Success Through Integrated Support And Management.

We understand that building success requires not only hard work, but also the right support and management. That’s why we’re committed to providing our clients with an integrated approach that focuses on both.

Our goal is to keep you engaged throughout the entire process, from start to finish, so that we can work together to achieve your business objectives.

Our team of experts is here to support you every step of the way, providing the guidance and resources you need to succeed.

-

Meeting Rooms

-

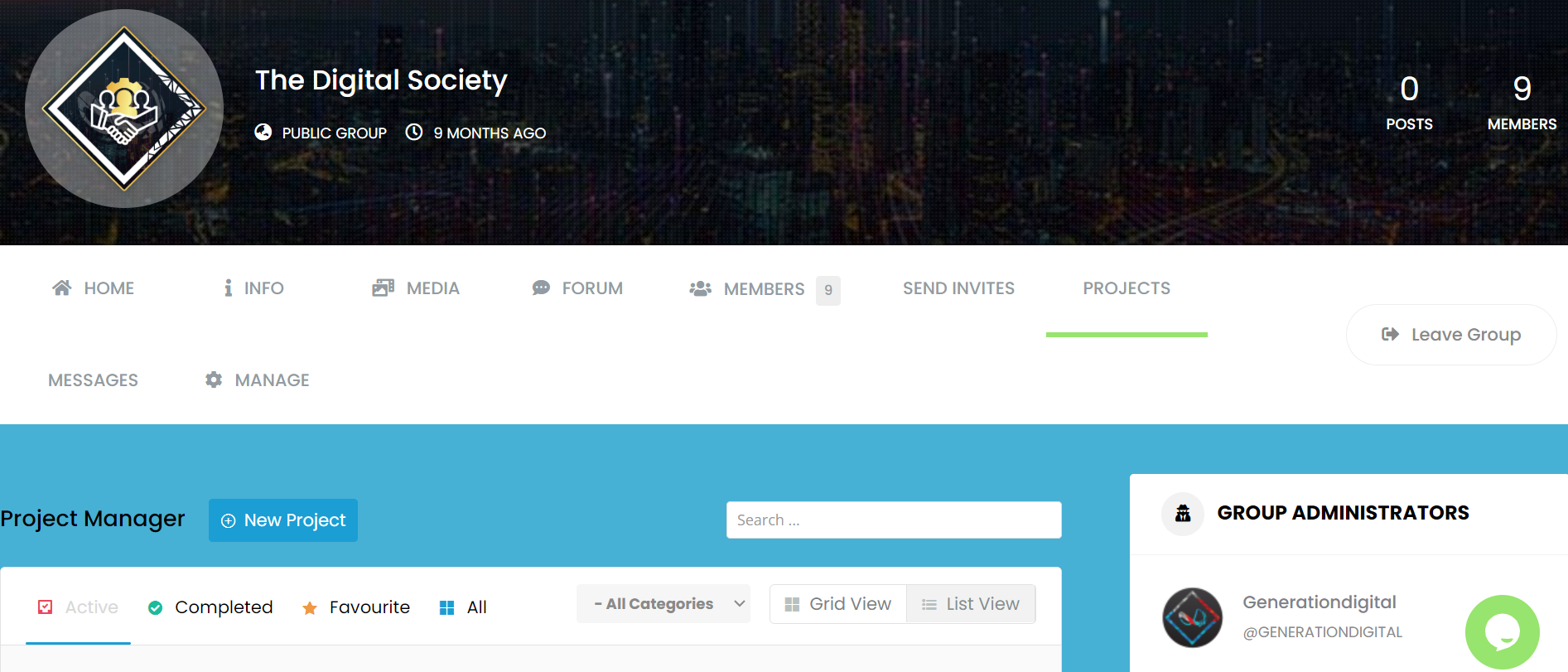

Empower Collaborative Connections within Your Business Meeting Room

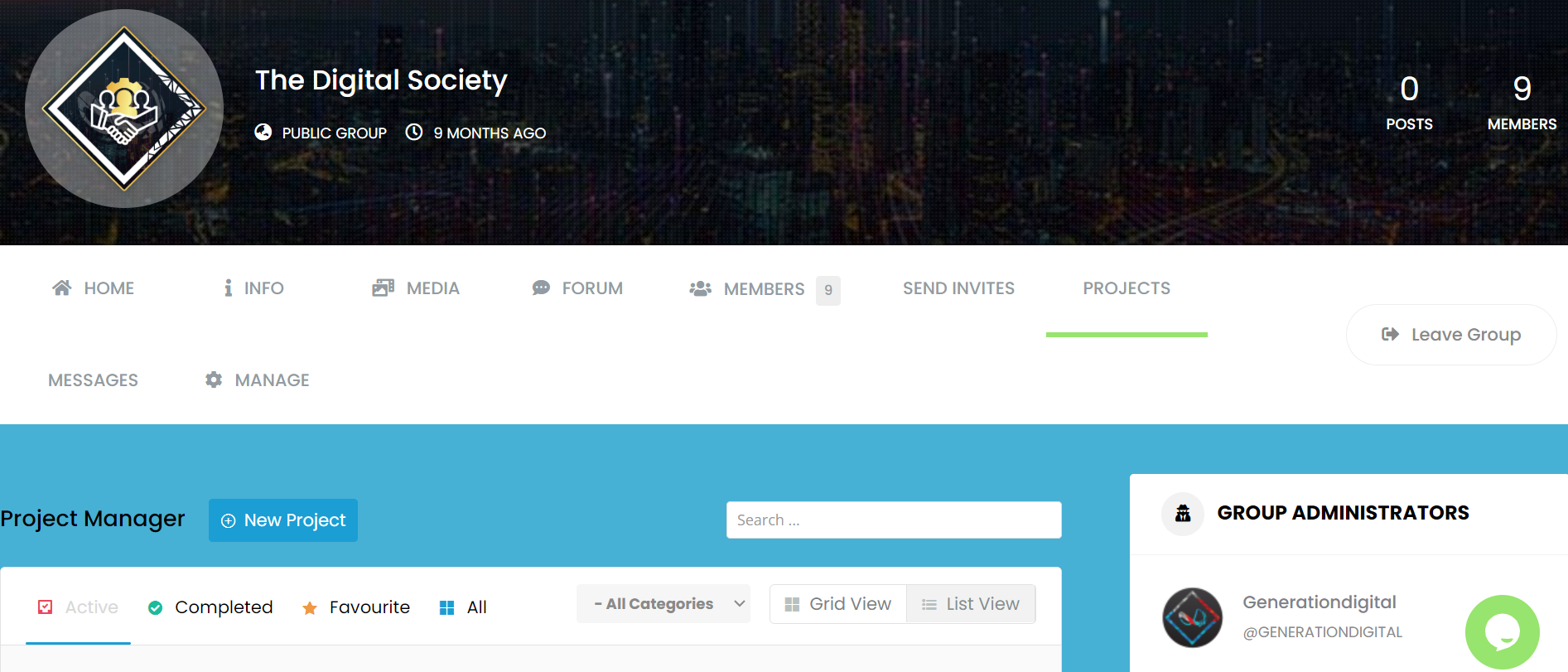

Virtual Meeting Rooms

Virtual Meeting RoomsA place for remote communication, project tasks, and file management.

When you launch a new business application with us, our Digital Navigator will extend an invitation to our Business Meeting Room, providing you with seamless access through your member account.

Our Business Meeting Room serves as a centralized hub for all your business updates, projects, and real-time messaging, streamlining your operations.

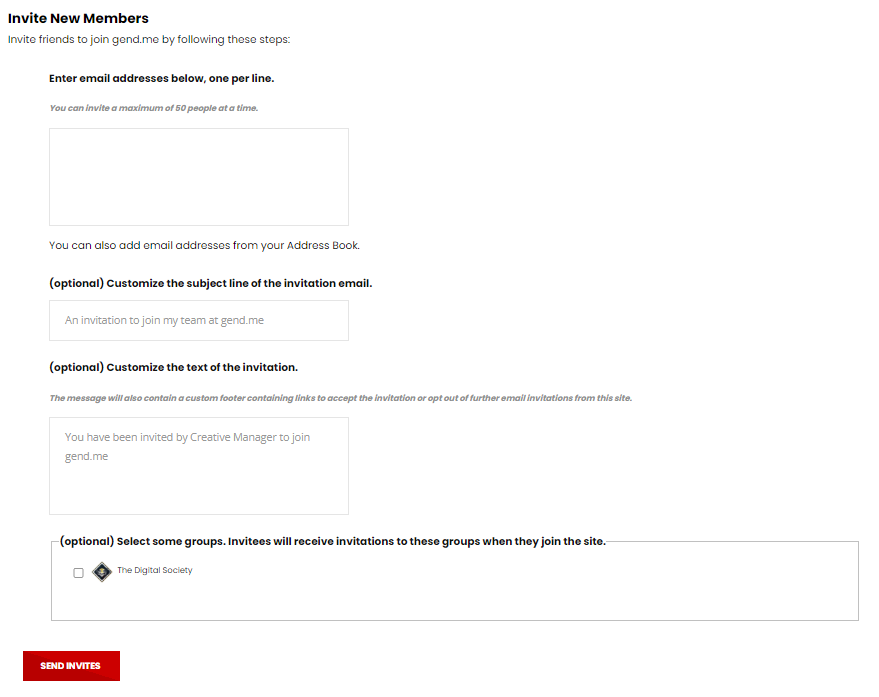

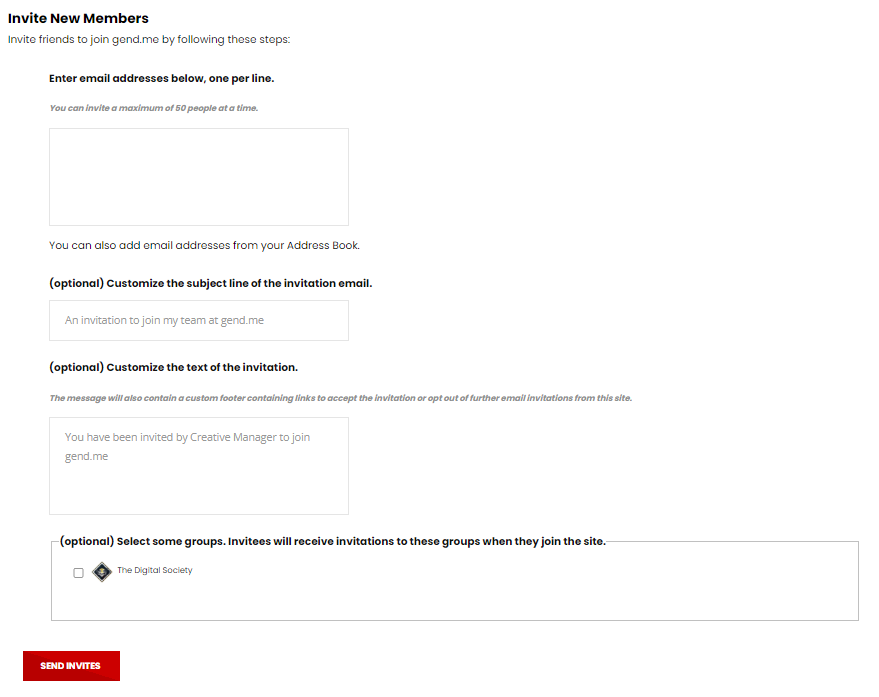

Effortlessly invite team members, partners, and anyone within your network who supports the growth of your digital business.

-

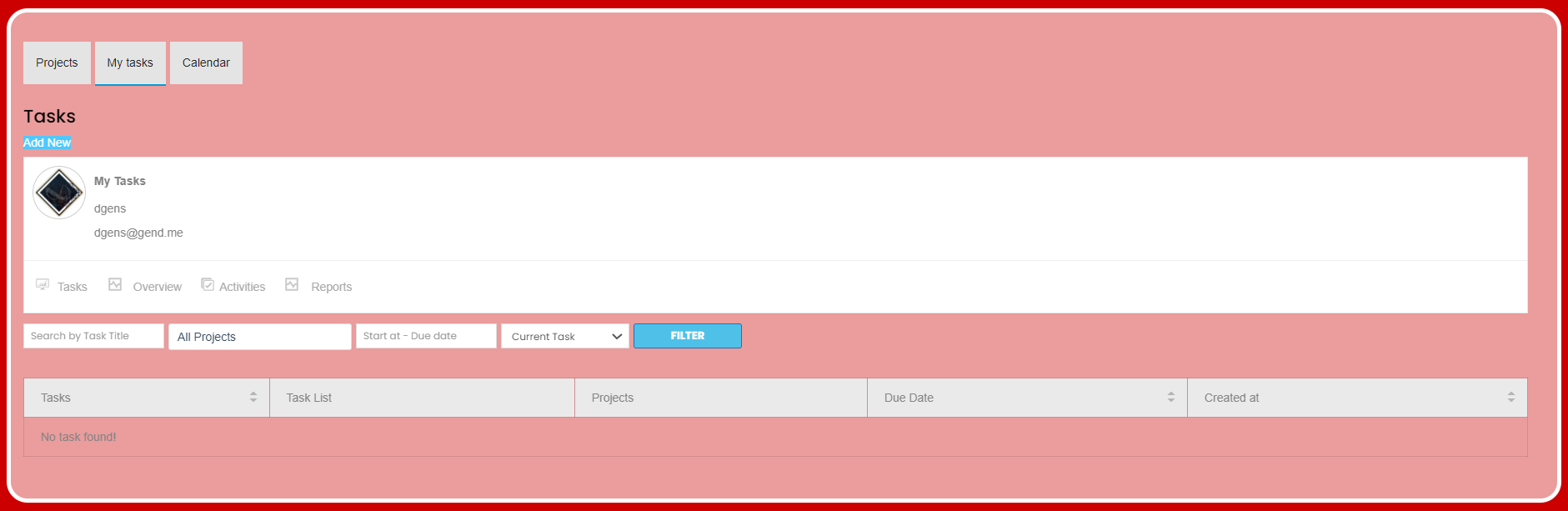

Remote Projects

-

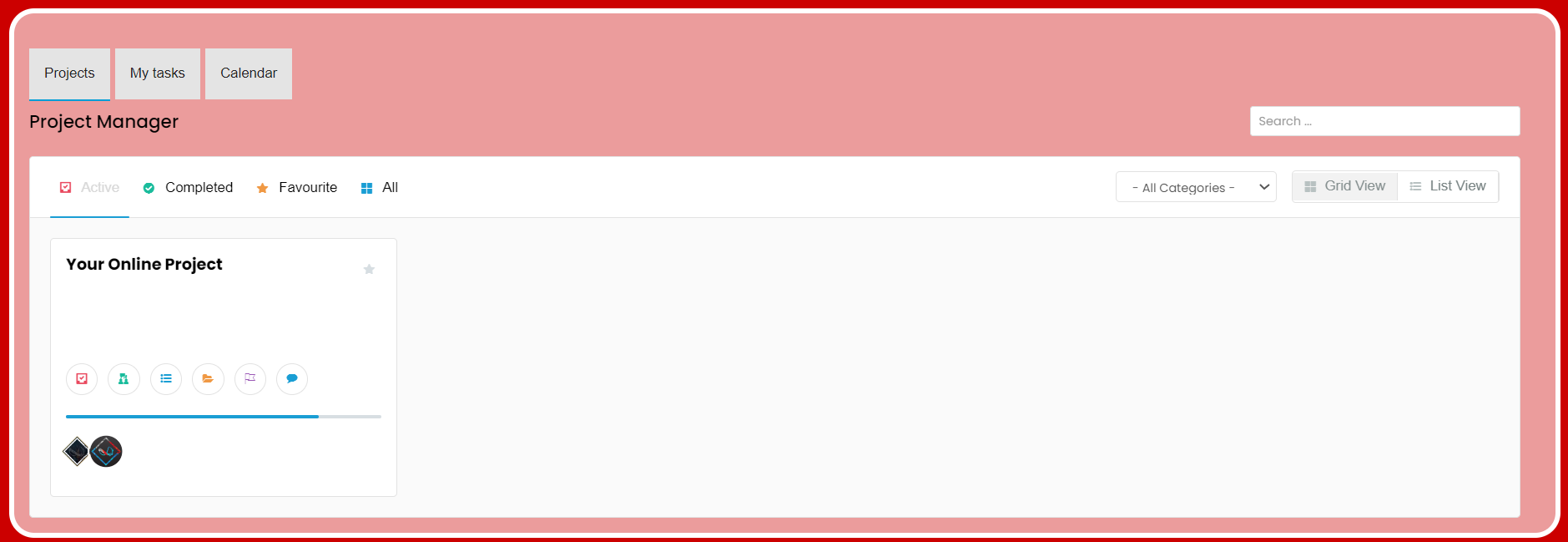

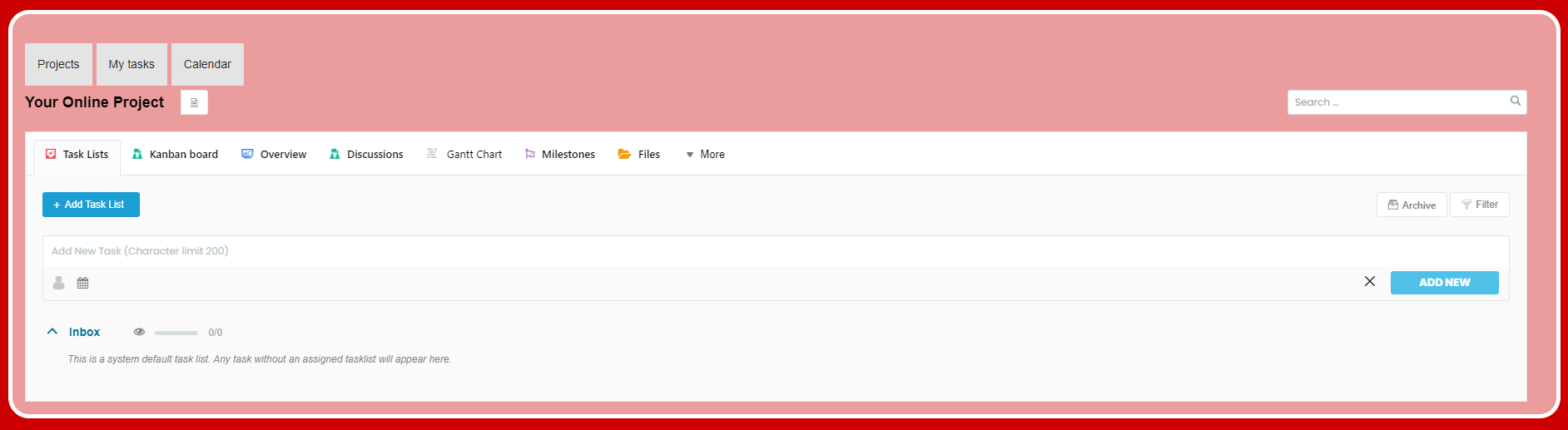

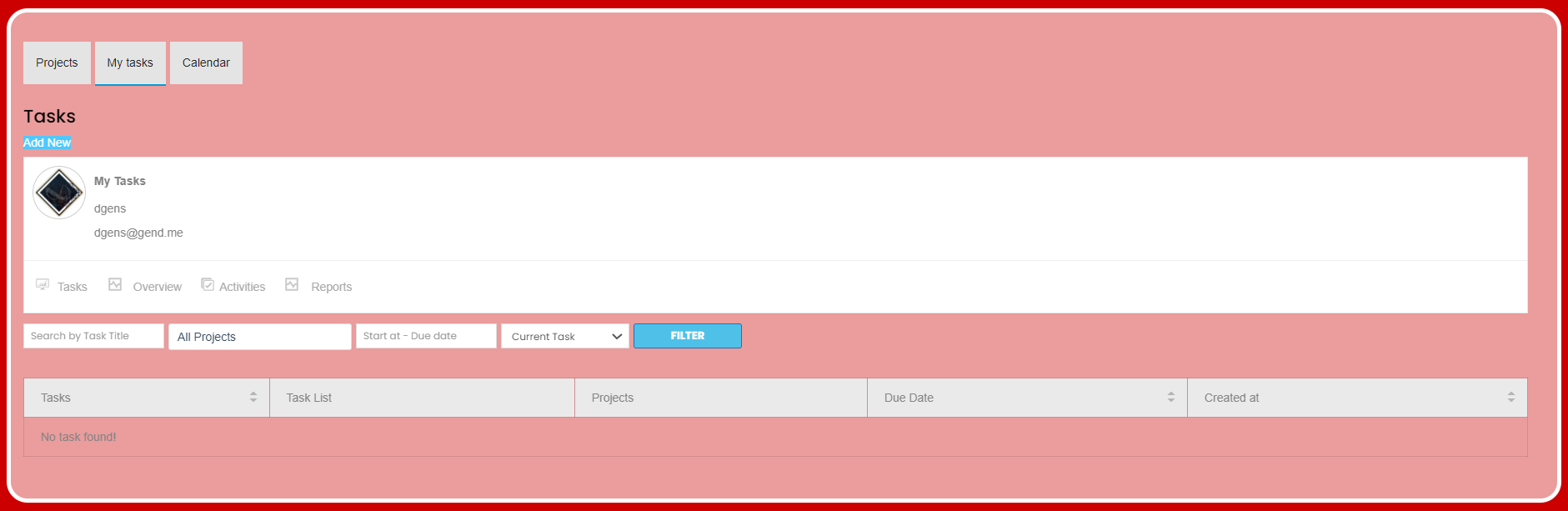

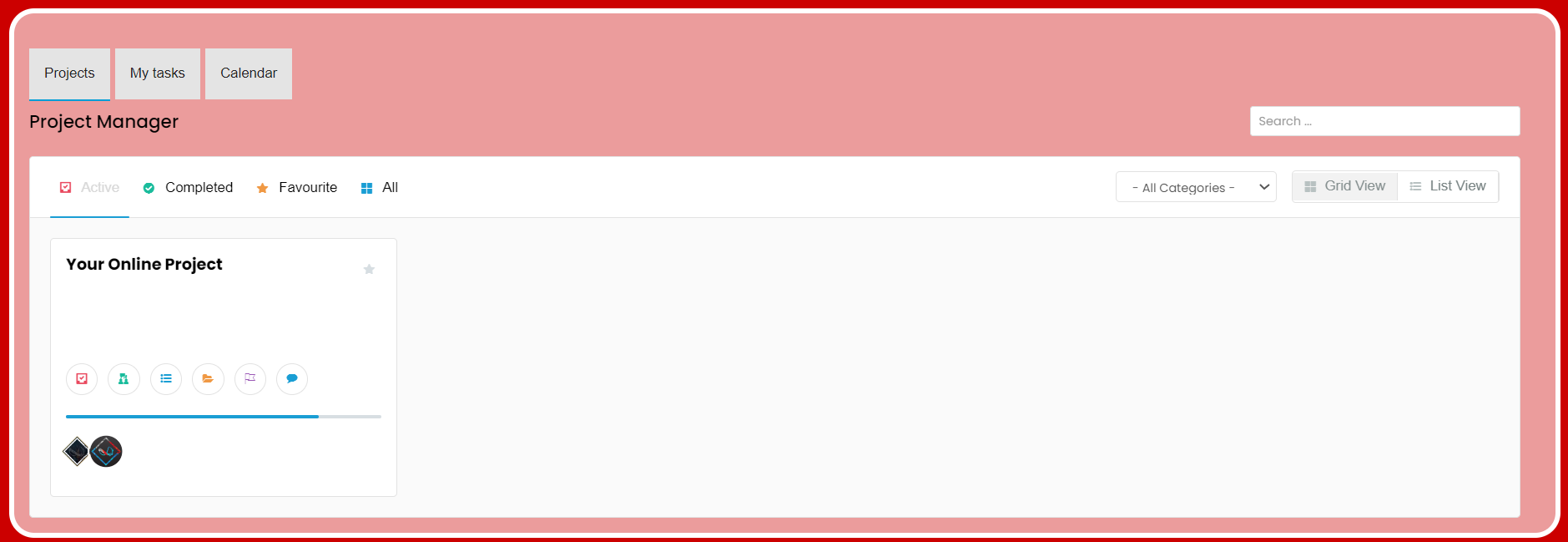

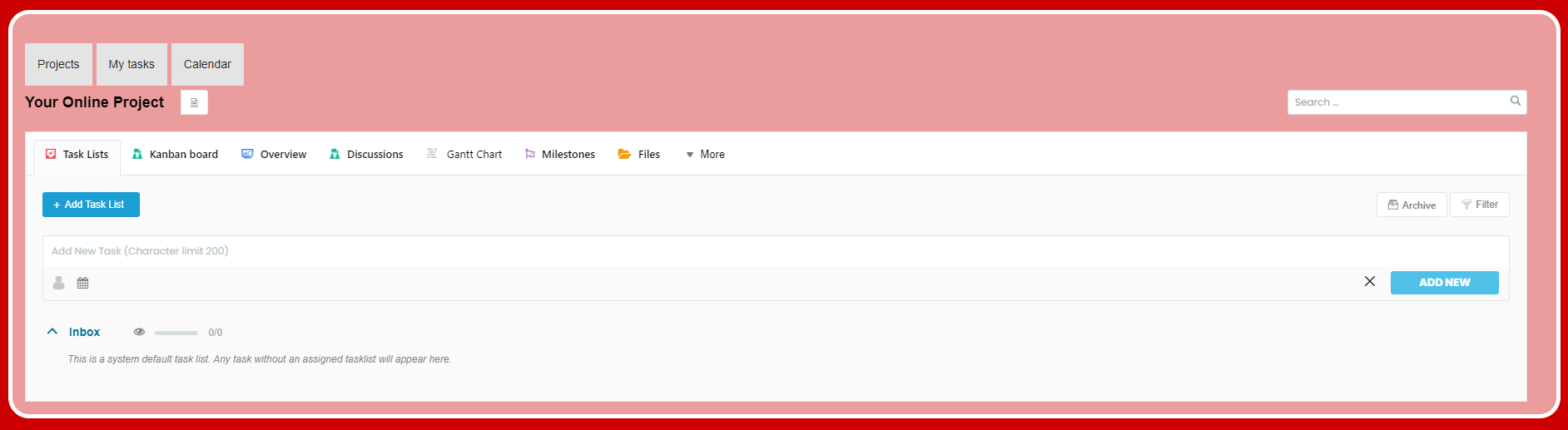

Effortlessly Collaborate on Projects with Our Remote Engagement Tools

Every project that you collaborate with us on will have its own dedicated workspace,

complete with a user-friendly interface that makes task management a breeze.

Say goodbye to manual tracking followups and hello to a streamlined process that keeps us on top of all our to-dos.

-

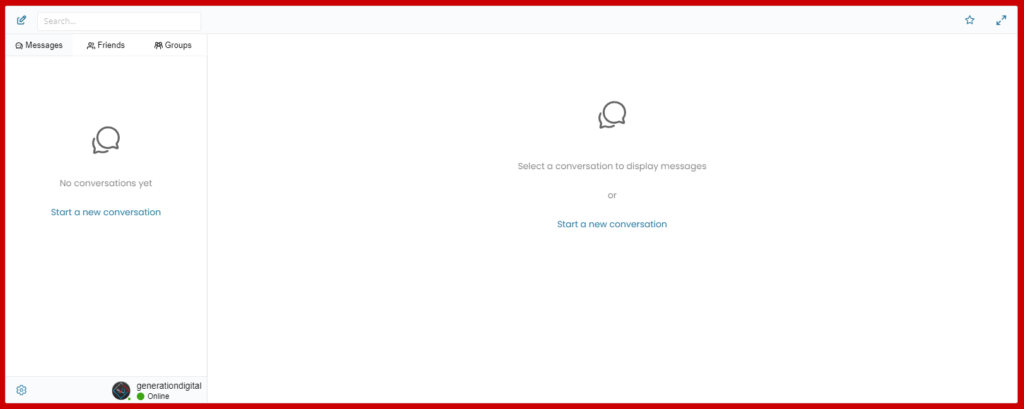

Member Chat

-

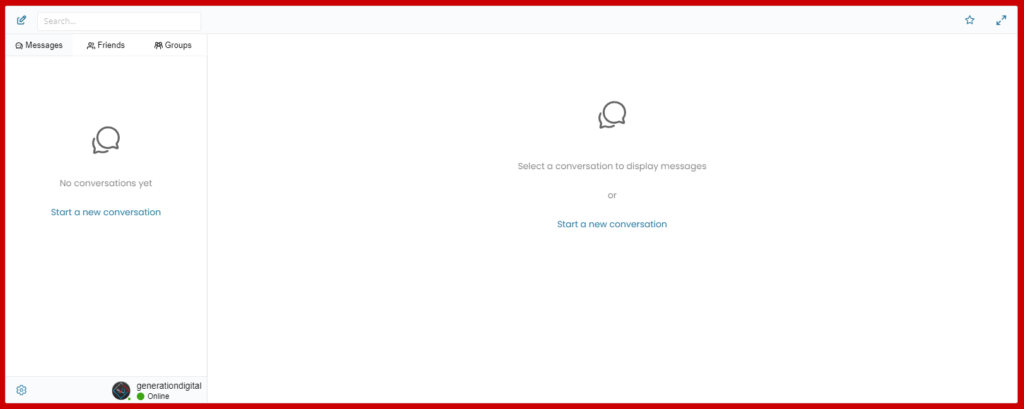

Effortlessly Collaborate on Projects with Our Remote Engagement Tools

As a registered member of www.gend.me, you have access to our live Member-to-Member Project Chat feature, which allows you to connect with other members and groups to discuss your projects.

Whether you’re looking for feedback, ideas, or collaboration opportunities, our chat feature makes it easy to connect and communicate with like-minded individuals. Plus, if you’re not online, you’ll still receive all chat messages via email, so you’ll never miss an important conversation.

Join our community today and start chatting with other members about your project!

At www.gend.me, we’re dedicated to providing exceptional digital support to all of our registered members.

That’s why we offer a convenient chat feature where you can connect with our Digital Navigator anytime you need network-wide support. Whether you have questions about using our platform, need assistance with a technical issue, or just want some advice on how to grow your digital presence, our Digital Navigator is here to help you every step of the way.

When you launch a new business application with us, our Digital Navigator will extend an invitation to our Business Meeting Room, providing you with seamless access through your member account.

Our Business Meeting Room serves as a centralized hub for all your business updates, projects, and real-time messaging, streamlining your operations.

Effortlessly invite team members, partners, and anyone within your network who supports the growth of your digital business.

Effortlessly Collaborate on Projects with Our Remote Engagement Tools

Every project that you collaborate with us on will have its own dedicated workspace,

complete with a user-friendly interface that makes task management a breeze.

Say goodbye to manual tracking followups and hello to a streamlined process that keeps us on top of all our to-dos.

Effortlessly Collaborate on Projects with Our Remote Engagement Tools

As a registered member of www.gend.me, you have access to our live Member-to-Member Project Chat feature, which allows you to connect with other members and groups to discuss your projects.

Whether you’re looking for feedback, ideas, or collaboration opportunities, our chat feature makes it easy to connect and communicate with like-minded individuals. Plus, if you’re not online, you’ll still receive all chat messages via email, so you’ll never miss an important conversation.

Join our community today and start chatting with other members about your project!

At www.gend.me, we’re dedicated to providing exceptional digital support to all of our registered members.

That’s why we offer a convenient chat feature where you can connect with our Digital Navigator anytime you need network-wide support. Whether you have questions about using our platform, need assistance with a technical issue, or just want some advice on how to grow your digital presence, our Digital Navigator is here to help you every step of the way.

We grow fastest together

You receive 20% revenue share from all your team member's ongoing purchases.

-

Earn 20% from all team member purchases with ease and convenience through our user-friendly website.

-

Automatic payments ensure you never miss out on your earnings and can easily withdraw funds anytime.

-

Our website allows you to effortlessly track your team's purchases and earnings, making it easier than ever to maximize your profits.